Hey Rebels! Let's dive into this week's issue to help you change how you think about money, investing and business in less than 10 minutes a week.

Weekly Intel

Stay current with top news from the business, money, and investing world.

Top Stories

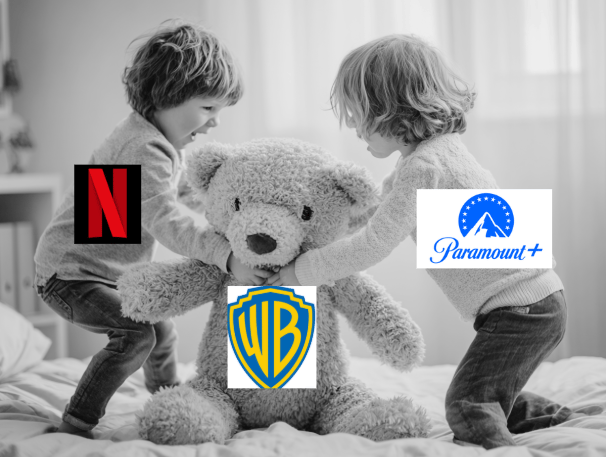

Streaming services, unite! Trump says the recent $72 billion Netflix-Warner Bros. deal may be a problem (of the monopoly variety), and Paramount agrees with him; unless they can get Warner Bros., it isn’t an issue. (more)

Young people are stupid with money!!! Does that make you angry? Rage bait was named the Oxford Word of the Year. I’m just ticked that the “word of the year” is two words. (more)

A Formula 1 update: If you remember from last week, I bet on Lando Norris because I saw him outside of his hotel in Italy once. Well, I would like to announce that we won, folks! Though coming in third in the race, he had enough overall points to take home the championship, despite Max Verstappen doing all he could do. (more)

By the numbers

$108.4 billion: how much Paramount is paying in a last-ditch effort to buy out Warner Bros. away from Netflix. (more)

Three: how many casinos have been announced in New York. Wasn’t this the latest plot of Only Murders in the Building? (more)

56: how many years the $450 billion cosmetic retailer, Sephora, has been peddling its goods. I think she looks fantastic. (more)

Don’t keep the rebellion a secret! Copy and paste this link: {{rp_refer_url}} to a friend and share the love of the newsletter to earn some swag.

The Financial Rebellion Way

Knowledge and action to help you achieve a life you desire.

A recent Gallup study says that around 44% of Americans aged 18-29 own stocks. Are you a part of that 44%? Five years ago, that number was 37%. Improvement! But we can do better.

44% of People Your Age Own Stocks. What’s Your Excuse?

Time beats timing: Every year you wait costs you thousands in compound growth. The math is brutal and doesn’t care about your excuses.

Perfect is the enemy of profitable: Your investing friends didn’t wait for the ideal portfolio. They started messy and learned by doing.

Starting small beats starting never: Most young investors began with pocket change. You don’t need thousands—you need to begin.

Big picture: That 44% isn’t smarter than you. They just stopped overthinking and started investing. Meanwhile, the 56% on the sidelines will spend their 40s wishing they’d started in their 20s. Which group do you want to be in?

Markets - stocks and crypto

Click the image above or this link to earn a special $40 bonus.

Prices for the week ending December 5, 2025:

▲ S&P 500 | 6,870 | +0.90% |

▲ NASDAQ | 23,578 | +1.69% |

▼ GOLD | 4,233 | -0.48% |

▲ VICTORIA’S SECRET (VSCO) | 49 | +14.06% |

▲ CARVANA (CVNA) | 432 | +14.16% |

▼ BITCOIN (BTC) | 91,441 | -2.18% |

▼ ETHEREUM (ETH) | 3,145 | -1.46% |

Stock and Crypto Moves

Similar to my bangs: Interest rates are expected to get trimmed again, but what happens in 2026 remains uncertain due to mixed economic signals. (more)

Vroom vroom: Carvana’s stock jumps after it was announced that it will join the S&P 500 later this month. (more)

What is her secret? Victoria's Secret stock soars after above-estimated Q3 earnings, just in time for you to get a Christmas present for that “special someone” (@ Buddy the Elf)(I need to cite my source in case you think I’m just being weird). (more)

Building a house for the bubble: IBM is buying data infrastructure company Confluent for a hefty $11 billion to help IBM handle data faster and better handle the AI demand. (more)

Crypto’s Comeback: The crypto market rebounded, with Bitcoin climbing above $91,000 and Ethereum rising above $3,130. However, the rebound comes after a sharp early-month sell-off, underscoring ongoing volatility and debate over whether the recovery is sustainable. (more)

Real Money Moves

Marcus, 27 - Tampa, Florida

Each week, we feature a reader’s smartest and dumbest money moves. We’re all in this together; let’s learn from each other.

Best Money Move - Buying his car with cash

“Saved for two years straight, threw every bonus and side hustle dollar at my car fund.”

“Walked into the dealership with $18,000 cash and negotiated another $2,000 off because I wasn’t financing.”

“No monthly payments, no interest, no stress. That $400/month I’m not spending on a car loan? Goes straight to investments now.”

Worst Money Move - Not maintaining the car

“Figured since I owned it outright, I could skip oil changes and save money.”

“Ignored that weird knocking sound for six months because ‘it still runs fine.’”

“Engine seized at 80,000 miles. My $18,000 car became a $6,000 paperweight because I was too cheap to spend $40 on oil changes.”

The bottom line: Every money move teaches you something — whether it builds your net worth or humbles your ego.

Got a story? Send it in. You might help someone dodge a mistake or make a smarter call.

Side Hustle Differently

Each week, we focus on money-making opportunities for a side hustle that could potentially become a full-time venture. No MLM schemes, no “passive income” lies, just real strategies for stacking cash outside your 9-5

Paper Perfectionist

Turn your grammar skills into cash by editing college papers and business documents.

Your editing empire:

Finals Week Gold Rush: Charge desperate students $50-100 to polish their papers. Three edits = rent paid.

Corporate Cash Cow: Business pros pay $75/hour to sound smart in emails and presentations. Way better than student rates.

Application Season ATM: College essays go for $200-500 per package. Parents pay premium for dream school admissions. (Just don’t write it for them, okay?!)

Big picture: While everyone’s trying to go viral, you’re quietly making $50-100/hour fixing bad writing. No inventory, no shipping—just you, a laptop, and people who need to sound smarter. With AI making first drafts worse, your human editing skills are pure gold.

Check out the Financial Rebellion podcast to learn about how to turn your passion into profit.

Word of the Week (and year) - Rage bait

Content that attempts to provoke outrage or anger with the goal of increased engagement and attention.

Trusted Partners

Where you bank is a big deal. We are big fans of credit unions to help you become financially rebellious. Here are some of our current partners that we work with around the country, so you can get to know them and the value of becoming a member to help you achieve your financial goals and dreams.

Did you know the myths about credit unions versus banks? Debunked here.

Was this email forwarded to you? Subscribe here.

Interested in becoming a Financial Rebellion Partner? Reach out to [email protected].

We’ll catch you next week. Rebels OUT.

Todd Romer: Founder and Writer

Corinne Clarkson: Writer and Editor

Dallin Merrill: Chief Newsletter Overlord

Disclaimer: The advice provided in Financial Rebellion is not considered to be financial or legal advice of any kind. It is your responsibility to dig deeper on any opinions or recommendations given.